All You Need to Know about Subprime Mortgage

Oct 11, 2023 By Susan Kelly

It is common for lenders to give subprime mortgages to people who have less than stellar credit histories. Because the lender believes the borrower has a higher chance of defaulting, the lender does not issue a conventional premium mortgage. Subprime mortgage interest rates are generally substantially greater than premier mortgage interest rates since lenders are taking on greater risk. These are mostly ARMs, which means that the interest rate may rise at predetermined intervals in the future.

A Subprime Mortgage Definition & Example

Subprime mortgages have significant interest charges and are often offered to people with credit ratings less than 620. Loans like this one allow people with bad credit to purchase houses, but there are significant dangers. These mortgages often have a low beginning interest rate since they are adjustable-rate mortgages (ARMs). In the beginning, the lower interest rate might make the payments more affordable, but it expires after a certain amount of time. Interest rates will change after the original rate expires, depending on market circumstances. The borrower may experience payment shock as a consequence, which might lead to payment defaults or perhaps even foreclosure.

The Working of a Subprime Mortgage

The interest rate granted to a borrower depending on his or her credit record is referred to as "prime" and sometimes "subprime." Borrowers with great credit are eligible for the lowest-rate mortgage, known as a "prime." If you're subprime, you'll be eligible for loans with greater interest prices and fewer favorable conditions because of your bad credit history. If a borrower falls into one of the following categories, they may be termed subprime:

- A Credit score of less than 620.

- Delinquent payments in your credit history.

- In the recent five years, you've made at least one bankruptcy filing.

- An excessive debt-to-income ratio.

- You've had your home repossessed or have been in the midst of bankruptcy.

Kinds of Subprime Mortgages

Listed below are a few of the most popular varieties of subprime loans.

Interest-Only Mortgage

For a certain amount of time, you will only be required to pay interest charges on an interest-only mortgage. While your payments may initially be minimal, they may climb significantly when the first time is finished. Many individuals get interest-only loans with the intention of refinancing before their payments rise. You may be unable to refinance if the value of your home drops or if your financial condition deteriorates.

Adjustable-Rate Mortgage (ARM)

An ARM, in contrast to a fixed-rate mortgage, has interest rates that fluctuate throughout the course of the loan. A modest initial rate will be applied to your account before interest rates change based on market circumstances. First, be sure you can handle the increased interest rate on your mortgage before registering for an adjustable-rate mortgage (ARM). The interest rate ceiling can help you evaluate if you can manage greater monthly payments on your mortgage.

Balloon Payments

A balloon payment is a big, one-time payment due at the conclusion of your mortgage term. Until the balloon payment, your installments may be smaller, but the ultimate payment might be in the hundreds or thousands of dollars. Before you commit to this kind of loan, you should first determine whether or not you will be able to pay the balloon payment when it becomes due. Refinancing first might leave you in a terrible financial position, so be cautious.

Exceptional Occurrences

Subprime mortgage failures were substantially to blame for the financial crisis of 2008. It's possible that subprime consumers may get loans with no earnings or down payment requirements at all. Some lenders counted on the reported income of the borrower, which meant that the borrower might claim to make six figures but didn't have to give any proof. So many people were approved for loans they couldn't afford as a result. These borrowers caught themselves in over their heads when the property market collapsed. When the property was valued less than the mortgage, they could not afford the increased interest rates on their mortgage payments.

The Pros and Cons

Getting a mortgage when you don't ordinarily fit for one is among the main advantages of subprime mortgages. You shouldn't take out a subprime loan simply because you are eligible for one. Benefits aside, there are a number of dangers that need to be considered:

Higher rates:

People who apply for subprime mortgages often have low credit ratings and financial difficulties. For this reason, a lender would be wise to avoid this sort of loan altogether. Lenders demand higher loan rates to counteract this risk. Traditional 30-year fixed-rate mortgages now have an average interest rate of less than 3%. However, subprime mortgages may have an interest rate of up to 9% to 10% and demand larger down payments.

Larger down payment:

Subprime mortgages may be mitigated by demanding greater down payments, which can range from 26% to 35%, based on the kind of loan. This might be difficult if property prices are rapidly increasing and you run the danger of being pushed out of your ideal community. You must also exercise caution when it comes to investing a significant portion of your liquid assets in your property. A financial emergency necessitates having a sufficient amount of savings to cover all of your needs, such as your mortgage payment.

Higher payments:

Subprime mortgages feature higher interest rates, which implies larger monthly payments. If you don't have the money to pay back the loan, lenders will undoubtedly be aware of that. But if your financial condition changes, such as if you become unemployed or have a medical issue, those hefty premiums may be too much for you. Defaulting on a mortgage payment may severely harm your credit, and it might even lead to a foreclosure.

Longer terms:

Conventional mortgages generally have lengths of 15 to 30 years. Mortgages issued by subprime lenders might have payback terms of up to 40 or 50 years. So you may spend a significant portion of your life making a home payment. But this also implies that the total amount of interest that you will have to pay back for the whole of the loan will be much higher.

Should You Purchase A Rental Truck Insurance?

Nov 16, 2023

When renting a moving truck, you should find out if it is covered by insurance. After all, if most of your things are in the truck and something bad happens, you might want to know what kind of protection you have. Here are some things to think about before you rent a moving truck

Wash Sale Rule for Capital Gains Tax

Nov 03, 2023

By the wash sale rule of the Internal Revenue Service (IRS), an investor is not permitted to buy the same securities (or substantially comparable ones) within thirty days before or after the sale of such assets.

How Long Does it Take to Get a Mortgage Pre-Approval

Feb 25, 2024

Buying a home is an exciting - and intimidating - process. Find out how long you can expect to wait for pre-approval on your mortgage and what factors might affect the timeline.

Best Real Estate Agencies in 2023

Dec 05, 2023

The real estate market across the country is rising. In many parts of the country, a home will be on the market for a week before it is swamped with bids from potential buyers. Because mortgage rates are at record lows, the market favours sellers like never before, and buyers are snapping up homes on the market faster than ever before

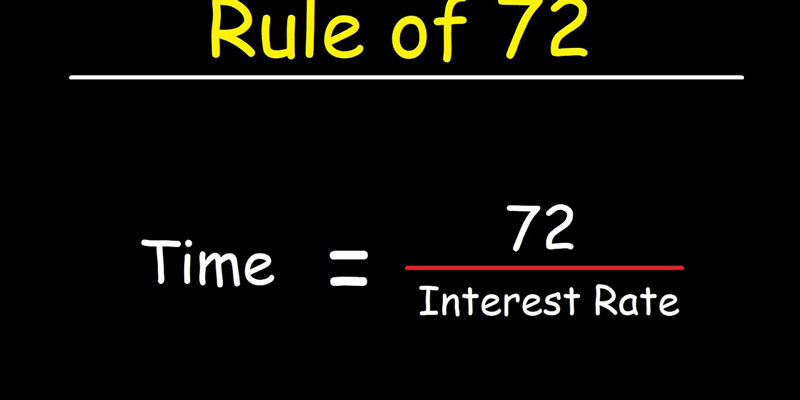

What Is the Rule of 72?

Jan 17, 2024

Rule of 72 is a simplified formula that determines how long the investment's value will take to increase its value according to the rate of return.

Property Tax Appeals: When, How, and Why to Submit?

Dec 20, 2023

The process to make property tax appeals is easy to correct any errors in your property taxes. Read the article to learn when and how you should make a property tax protest application.

The Top Gold Exchange-Traded Funds to Hedge Volatility

Oct 16, 2023

There is more than one way to acquire exposure to gold, the most direct of which is the purchase of gold bullion. Other means, such as ownership of shares in public mining firms, are more indirect. Exchange-traded funds (ETFs) that include gold as their underlying asset are the most effective way for ordinary investors to get a piece of the action because of the low transaction costs. While some funds directly invest in the metal itself, others instead manage a portfolio of equities tied to the gold industry.

Best Stocks With Monthly Dividends To Buy Now

Jan 15, 2024

Stocks that pay dividends regularly can be held indefinitely without affecting the investor's standard of living. Monthly dividend stocks are popular among investors because they provide a more consistent cash flow than their quarterly and annual counterparts. This post will discuss the top stores offering monthly dividends that investors may buy right now and the rationale behind our selections.

Comparing Condos vs. Co-ops: What Are the Key Differences?

Nov 19, 2023

Condos and co-ops are two different types of housing with significant distinctions. Ownership structure, funding alternatives, taxes, pricing, and fees are examples of these. Management companies for co-ops and condominiums are distinct. The co-op equivalent of a homeowners' association is a board or committee (HOA). Co-ops sell shares under a fractional ownership structure, whereas condos give exclusive ownership. Co-op shareholders screen each other before the entrance, unlike condo owners. Financial documents, credit histories, and other records may all be examined..

Oregon Mortgage Lenders

Dec 07, 2023

These mortgage lenders can assist you regardless of whether you are a first-time home buyer, need to make a modest down payment, are looking for a lender that doesn't mind a poor credit score, prefer an internet lender, or want to borrow against the equity in your home.

Get To Know Which States Tax Social Security Benefits

Feb 27, 2024

Moving to a lower-tax state or country can help retirees stretch their money further. Social Security and pensions are exempt from taxation in these states.

A Guide To Earning Money On eBay

Jan 25, 2024

There is a need for a centralized location where individuals can meet to do business via the internet, and this is precisely what e-commerce platforms aim to provide. The only way to make money on such an e-commerce site is to sell something.