Top Consumer Goods Stocks to Consider for Your 2024 Investment Portfolio

Sep 10, 2024

consumer goods stocks, 2024 stock market, investing in consumer goods

What Does a Stock Quote's Bid and Ask Mean?

Feb 16, 2024

Bid and ask prices are a trader's optimum purchase and sell pricing. The bid cost is the most a buyer is willing to shell out for a financial asset, whereas the asking rate is the least. The bid-ask spread refers to the disparity between bid and ask

Do You Know: What Is Reinvestment Risk?

Feb 05, 2024

Cash flows from an investment, such as interest or coupon payments, are subject to reinvestment risk if the investor is concerned about not being able to reinvest them at a rate of return at least equal to the current rate. This new interest rate is known as the reinvestment rate. Since zero-coupon bonds never pay a coupon, they are risk-free investments.

Outstanding Shares: What is it?

Jan 30, 2024

Shares outstanding are the total number of shares of a company's stock, usually controlled by all stakeholders. This number includes both Outstanding and Floating Shares.

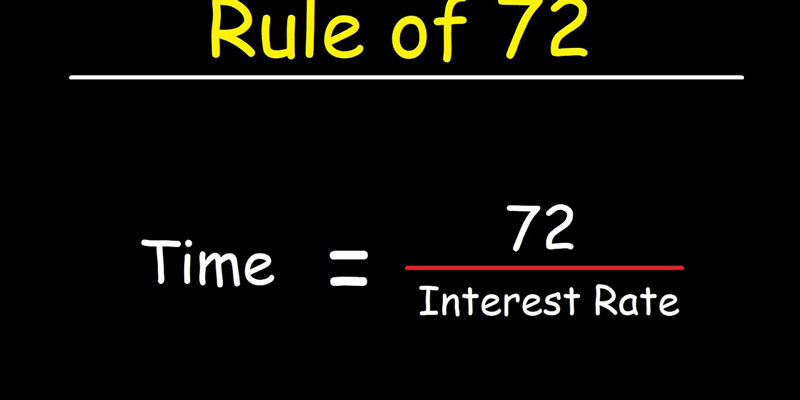

What Is the Rule of 72?

Jan 17, 2024

Rule of 72 is a simplified formula that determines how long the investment's value will take to increase its value according to the rate of return.

Best Stocks With Monthly Dividends To Buy Now

Jan 15, 2024

Stocks that pay dividends regularly can be held indefinitely without affecting the investor's standard of living. Monthly dividend stocks are popular among investors because they provide a more consistent cash flow than their quarterly and annual counterparts. This post will discuss the top stores offering monthly dividends that investors may buy right now and the rationale behind our selections.

Understanding the Basics of Form 1099-DIV: A Comprehensive Guide

Jan 07, 2024

Navigate tax reporting with ease! This guide simplifies Form 1099-DIV, highlighting its importance, explaining the information it contains, common mistakes to avoid, and tips for accurate tax filing

Repairs Notified During Property Condition Verification

Nov 28, 2023

We were initially unable to react to this email since your home buying guide is a REALTOR®. She is not allowed to interfere with another REALTORtransaction ®'s as a fellow REALTOR®! Therefore, the only appropriate response to this was to seek your agent for advice on how to verify the condition of the property.

The Top Gold Exchange-Traded Funds to Hedge Volatility

Oct 16, 2023

There is more than one way to acquire exposure to gold, the most direct of which is the purchase of gold bullion. Other means, such as ownership of shares in public mining firms, are more indirect. Exchange-traded funds (ETFs) that include gold as their underlying asset are the most effective way for ordinary investors to get a piece of the action because of the low transaction costs. While some funds directly invest in the metal itself, others instead manage a portfolio of equities tied to the gold industry.