What Does a Stock Quote's Bid and Ask Mean?

Feb 16, 2024 By Triston Martin

The market phrases that reflect the stock's demand & supply are known as the bid price & the asking price. You can see how much someone is prepared to spend on a share by looking at the bid. The lowest price that somebody is ready to sell a share is referred to as the "ask." Spread is a bid-ask difference. A stock's current stated price is the value at which it was sold most recently.

Important Notes

- Stocks are traded at their highest and lowest bid prices, respectively, on the stock market.

- It is the lowest rate that a vendor is willing to take at this time.

- The bid-ask spread is indeed the distinction. The lesser the liquidity, the larger the spread.

- A transaction occurs when somebody is ready to sell or purchase at the bid or ask price.

- Market makers are large corporations that publish both the bid & ask prices in order to generate revenue from the difference between the two.

The Difference Between Ask & Bid Prices

An investor submits a request to their broker in order to execute a deal. Based on the sort of order you place, the trading mechanics will be slightly different. Stock exchanges accept offers from brokers as part of their standard operating procedure. The number of shares sought and the suggested acquisition price are included in each offer to buy. A stock's bid is the highest price at which it is suggested to acquire the shares, and it shows the demand side of the marketplace for that stock.

There is a quantity provided and a price indicated in each offer to sell. The ask is the lowest price at which a stock may be sold, and it reflects the supply aspect of the market. If a current ask equals an established bid, an order to purchase or sell is executed. There won't be any transactions between brokers if no orders are placed to cross the bid-ask spread. If no orders cross the spread, organizations known as market makers offer both bids & ask prices to keep markets running smoothly.

A Stock Quote's Bid & Ask Prices Indicate What, Exactly.

The price of a commodity that is shown on a monitor or chart represents the most recent value at which a purchaser & a seller reached an agreement to execute a transaction. It does not, however, indicate the value at which the future buyer or seller might anticipate acquiring or selling the exact asset in the past. Markets are made up of a variety of buyers & sellers, all of whom are trying to get the best deal possible for themselves. To possess security, buyers want to spend the minimum, while sellers wish to be paid more.

You may call it accepting the ask or accepting a seller's offer when you agree to their price in order to conclude a deal. In the real estate market, this is known as "hitting the bid." Limit & stop orders are three types of stock order types that provide different levels of flexibility to the parties involved.

- The no. of shares requested will be filled irrespective of the price in a market order.

- Orders placed with a restriction on the no. of shares to be purchased must be filled at a certain price, if not higher. Traders who only wish for a transaction to take place if the value is just right to utilize a limit order.

- And lastly, in order for a stop order to be converted into a market order, it is necessary for another transaction to take place at the price that was previously indicated. A stop-loss order is often employed by investors who wish to minimize their losses or anticipate a market breakout.

Bid & Ask Prices Illustrated

Assume ABC has a present best offer of $9.95 for 100 shares and a present maximum ask of $10.05 for 200 shares. If neither the buyer nor the seller reaches the requested price, no deal will be made. Let's say an investor wants to acquire 100 shares of ABC Corporation at the current market price. Till the order is completed, the offer price will rise to $10.05. This example's bid will rise to $9.95 if such 100 shares are sold before the next top bid.

What Separates a Stock's Ask Price From Its Bid Price?

If a stock's bid & ask prices are different, the spread makes up the difference. When it comes to liquidity, a general rule of thumb is that a stock has less of it when the spread is wider. A big order might trigger a price drop owing to slippage if the supply is very scarce.

Last and New Last Price

The latest price is the price at which the most recent deal was executed. The price of the deal becomes the new last price if a trader sets a market purchase or sale order.

When It Comes To Stocks, What Do The Terms "Bid Size" And "Ask Size" Imply?

Bid size & ask size show the number of shares traders are ready to purchase or sell at a specific price. The ask size of four suggests that 400 units are accessible for that rate in batches of 100. The marketability of security is inversely proportional to its bid/ask size.

Outstanding Shares: What is it?

Jan 30, 2024

Shares outstanding are the total number of shares of a company's stock, usually controlled by all stakeholders. This number includes both Outstanding and Floating Shares.

Should You Purchase A Rental Truck Insurance?

Nov 16, 2023

When renting a moving truck, you should find out if it is covered by insurance. After all, if most of your things are in the truck and something bad happens, you might want to know what kind of protection you have. Here are some things to think about before you rent a moving truck

Understanding Texas Home Equity Loans and HELOCs

Mar 19, 2024

Discover the ins and outs of Texas home equity loans and HELOCs in this comprehensive guide. Learn how they work and their benefits.

Comparing Condos vs. Co-ops: What Are the Key Differences?

Nov 19, 2023

Condos and co-ops are two different types of housing with significant distinctions. Ownership structure, funding alternatives, taxes, pricing, and fees are examples of these. Management companies for co-ops and condominiums are distinct. The co-op equivalent of a homeowners' association is a board or committee (HOA). Co-ops sell shares under a fractional ownership structure, whereas condos give exclusive ownership. Co-op shareholders screen each other before the entrance, unlike condo owners. Financial documents, credit histories, and other records may all be examined..

How Does Being Evicted Affect Your Credit?

Dec 29, 2023

When a credit bureau hears about an eviction, it can appear on your credit report for up to seven years. This can hurt your credit score, making it harder for you to rent a new place or get credit in the future. To keep your credit score from taking a hit, working with your landlord to solve any problems before you have to move out is essential.

Best Stocks With Monthly Dividends To Buy Now

Jan 15, 2024

Stocks that pay dividends regularly can be held indefinitely without affecting the investor's standard of living. Monthly dividend stocks are popular among investors because they provide a more consistent cash flow than their quarterly and annual counterparts. This post will discuss the top stores offering monthly dividends that investors may buy right now and the rationale behind our selections.

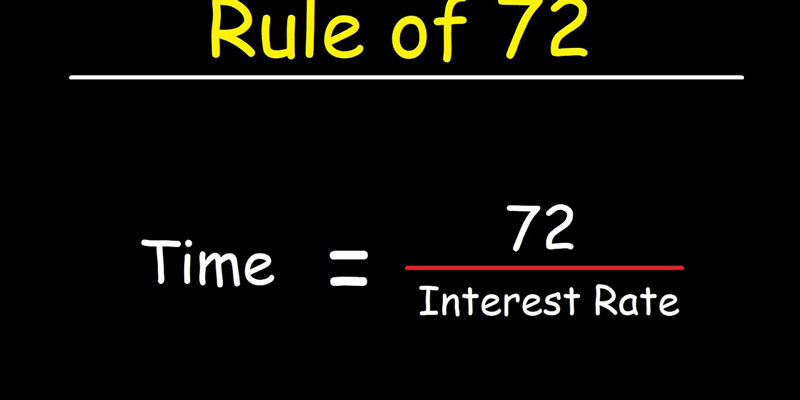

What Is the Rule of 72?

Jan 17, 2024

Rule of 72 is a simplified formula that determines how long the investment's value will take to increase its value according to the rate of return.

All You Need to Know about Subprime Mortgage

Oct 11, 2023

Customers with weak credit histories may apply for subprime mortgages, which carry high-interest rates. These loans allow people with bad credit to purchase houses, but they come with a high degree of risk

Jobs in Nonprofit Accounting

Nov 22, 2023

Accountant the role is just as crucial in the nonprofit sector as it is in the for-profit sector, and the tasks will be identical to those of a professional accountant. Treasurer. Vacancies for full-time financial officers tend to arise at larger nonprofits that attract sufficient funding to justify the position.

Understanding the Basics of Form 1099-DIV: A Comprehensive Guide

Jan 07, 2024

Navigate tax reporting with ease! This guide simplifies Form 1099-DIV, highlighting its importance, explaining the information it contains, common mistakes to avoid, and tips for accurate tax filing

What Does a Stock Quote's Bid and Ask Mean?

Feb 16, 2024

Bid and ask prices are a trader's optimum purchase and sell pricing. The bid cost is the most a buyer is willing to shell out for a financial asset, whereas the asking rate is the least. The bid-ask spread refers to the disparity between bid and ask

The Top Gold Exchange-Traded Funds to Hedge Volatility

Oct 16, 2023

There is more than one way to acquire exposure to gold, the most direct of which is the purchase of gold bullion. Other means, such as ownership of shares in public mining firms, are more indirect. Exchange-traded funds (ETFs) that include gold as their underlying asset are the most effective way for ordinary investors to get a piece of the action because of the low transaction costs. While some funds directly invest in the metal itself, others instead manage a portfolio of equities tied to the gold industry.