Understanding Texas Home Equity Loans and HELOCs

Mar 19, 2024 By Susan Kelly

Homeowners in Texas, also known as Lone Star State, can leverage their property equity through Texas home equity loans and Home Equity Lines of Credit (HELOCs). These financial products serve as valuable tools for funding a range of purposes, from home improvements to debt consolidation. This article delves into the intricacies of Texas-based HELOCs and home equity loans. It highlights their unique features, and benefits, all while considering factors that potential borrowers must keep in mind.

1. The Basics of Texas Home Equity Loans and HELOCs

Similarly to traditional mortgages, Texas home equity loans and HELOCs leverage a homeowner's accumulated property equity as collateral. Borrowers receive a lump sum at the beginning with home equity loans. On the other hand, HELOCs provide borrowers with a revolving line of credit that they can access when necessary. These loans usually offer either fixed or variable interest rates and have repayment periods varying from five to thirty years.

Further, we must delve into the mechanics of these loans. Home equity loans frequently feature fixed interest rates, a trait that renders monthly payments predictable. Conversely, HELOCs may bear variable rates. This could engender potential fluctuations in payment amounts. Moreover, access to a HELOC for borrowers might fluctuate according to modifications in two key aspects including the property's value and the lender's policies. Borrowers, by understanding these nuances, can make informed decisions about the type of loan that best suits their needs.

- Flexibility in Use: Home equity loans and HELOCs can also be used to finance investments, such as starting a business or purchasing additional properties.

- Credit Score Impact: Borrowers should be aware that applying for a home equity loan or HELOC can temporarily lower their credit score due to the credit inquiry and the new debt being added to their credit report.

2. Legal Framework and Regulations

Stringent laws and regulations in Texas govern home equity loans and HELOCs. Their design is twofold to safeguard consumers and to maintain equity within their homes. These comprehensive provisions include restrictions on loan-to-value ratios, limits imposed upon fees that lenders may charge, as well as mandatory waiting periods between loan application and closure.

Further expansion necessitates borrowers' comprehension of the precise legal requirements tied to Texas home equity loans and HELOCs. Consider this, for example, Texan legislation bars borrowers from exceeding a combined total, comprised of their existing mortgage balance plus 80% concerning the appraised value of their homes. Moreover, it is incumbent upon lenders to furnish detailed disclosures outlining loan stipulations including interest rates, fees, and repayment terms to borrowers before sealing the agreement. This action represents an essential statutory obligation.

- Legal Protections: Texas law provides certain protections for borrowers, such as the right to cancel a home equity loan within three business days of closing without penalty.

- Consultation Requirement: Borrowers in Texas are required to consult with an attorney before executing a home equity loan or HELOC, ensuring they fully understand the implications of the transaction.

3. Uses and Benefits

Homeowners in Texas can utilize the funds from home equity loans and HELOCs for a multitude of purposes such as essential home improvements, debt consolidation, or covering unexpected expenses. Furthermore, under specific circumstances, which present potential advantages for financial planning, they may deduct the interest paid on these loans as tax.

The tax deductibility of interest payments on home equity loans and HELOCs hinges on the utilization purpose. For example, one may deduct the interest paid from a loan used to enhance their primary residence. However, this deduction might not apply if they are servicing debts incurred for reasons such as funding vacations or buying luxury items. A comprehension of these tax implications empowers borrowers in strategizing their loan proceeds' usage more effectively.

- Potential for Appreciation: Investing in home renovations or improvements through a home equity loan or HELOC can increase the property's value, potentially yielding a return on investment in the form of higher home equity.

- Emergency Fund: Establishing a HELOC can serve as a valuable financial safety net, providing access to funds in the event of unforeseen emergencies or expenses.

4. Considerations for Borrowers

Borrowers must thoroughly assess their financial circumstances and objectives before committing to a Texas home equity loan or HELOC. They should evaluate key factors such as prevailing interest rates, repayment terms, and associated fees. They should also consider the potential impact on credit scores. To secure the most favorable terms, borrowers must shop around and compare offers from multiple lenders.

Borrowers should vigilantly scrutinize the total borrowing cost, which encompasses more than just the interest rate. It also includes origination fees, closing costs, and ongoing maintenance charges associated with their loan. This is an aspect they cannot afford to overlook. Further still, considering the potential consequences of defaulting on a home equity loan or HELOC becomes imperative for borrowers. Failure to repay might lead not only to foreclosure but other adverse legal actions by their lender.

- Rate Lock Options: Some lenders may offer rate lock options for home equity loans or HELOCs, allowing borrowers to secure a favorable interest rate for a specified period.

- Financial Counseling: Borrowers may benefit from seeking guidance from financial advisors or credit counselors to assess their overall financial health and determine whether a home equity loan or HELOC aligns with their goals.

5. Risks and Potential Pitfalls

Texas home equity loans and HELOCs offer valuable financial flexibility, yet borrowers must also grapple with their inherent risks. When they use home equity as collateral, the risk of foreclosure looms in case of default. This is a situation that could potentially lead to losing their house. Furthermore, because variable interest rates accompany HELOCs. This may spur unpredictable fluctuations in monthly payments which present significant challenges for budgeting and strategic financial planning.

Moreover, borrowers must exercise caution regarding how economic factors like fluctuations in property values or interest rates could influence their capacity to reimburse a home equity loan or HELOC. A downturn in the economy, along with decreases in real estate worth, might erode the borrower's home equity cushion. This elevates the potential for negative equity and foreclosure risk. Consequently, it becomes indispensable for borrowers to evaluate rigorously their financial stability and ability before embarking on acquiring a home equity loan or HELOC.

- Minimum Draw Requirements: Some HELOC agreements may impose minimum draw requirements, obligating borrowers to withdraw a specified minimum amount of funds within a certain timeframe.

- Early Termination Fees: Borrowers should review the terms of their loan agreement carefully to understand any penalties or fees associated with early repayment or termination of a home equity loan or HELOC.

Conclusion

Homeowners in Texas can harness the power of their property's equity for a myriad of purposes by utilizing home equity loans and HELOCs. Understanding the mechanics behind these financial tools, their legal governance framework, as well as borrower considerations empowers individuals to discern whether they should opt for these choices based on their unique financial goals and circumstances. Conducting comprehensive research, soliciting guidance from finance professionals, and meticulously evaluating all possible options remain paramount before committing to any loan.

What To Do About Your Student Loans in 5 Easy Steps

Oct 11, 2023

Do you feel completely paralyzed by the weight of your student loans? The good news is that you have a company: More than $1.6 trillion has been borrowed for education in the United States. That's just slightly smaller than the total national mortgage debt. Student debt makes it more difficult for recent graduates to enter the housing market.

Should You Purchase A Rental Truck Insurance?

Nov 16, 2023

When renting a moving truck, you should find out if it is covered by insurance. After all, if most of your things are in the truck and something bad happens, you might want to know what kind of protection you have. Here are some things to think about before you rent a moving truck

Top 7 Tips For Best Way To Save Money On Car Rentals

Dec 17, 2023

The return of the road trip is one of the most notable changes in vacation habits after the COVID-19 pandemic. However, the availability of rental cars may be constrained during times of strong demand. It comes as no surprise that the cost to rent a car is through the roof if you can even locate one to rent. The excellent news is that automobile rentals don't have to eat up your entire travel budget. Whether on a short weekend trip or a month-long vacation across the country, these 10 tips can help you save money on your rental car.

Understanding Texas Home Equity Loans and HELOCs

Mar 19, 2024

Discover the ins and outs of Texas home equity loans and HELOCs in this comprehensive guide. Learn how they work and their benefits.

How To Find Money Immediately During Emergencies

Nov 05, 2023

A straightforward savings account associated with your checking account. a money market account with check-writing or a debit card included. an online bank where you may still easily and immediately transfer money to your checking account while paying a higher interest rate.

How Does Being Evicted Affect Your Credit?

Dec 29, 2023

When a credit bureau hears about an eviction, it can appear on your credit report for up to seven years. This can hurt your credit score, making it harder for you to rent a new place or get credit in the future. To keep your credit score from taking a hit, working with your landlord to solve any problems before you have to move out is essential.

Oregon Mortgage Lenders

Dec 07, 2023

These mortgage lenders can assist you regardless of whether you are a first-time home buyer, need to make a modest down payment, are looking for a lender that doesn't mind a poor credit score, prefer an internet lender, or want to borrow against the equity in your home.

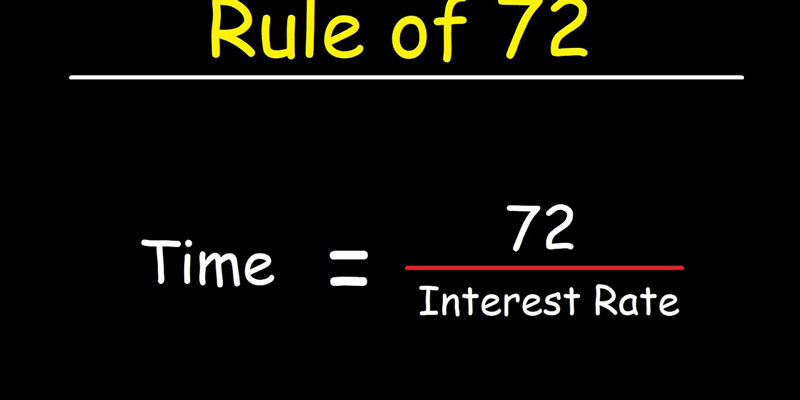

What Is the Rule of 72?

Jan 17, 2024

Rule of 72 is a simplified formula that determines how long the investment's value will take to increase its value according to the rate of return.

Understanding the Basics of Form 1099-DIV: A Comprehensive Guide

Jan 07, 2024

Navigate tax reporting with ease! This guide simplifies Form 1099-DIV, highlighting its importance, explaining the information it contains, common mistakes to avoid, and tips for accurate tax filing

Comparing Condos vs. Co-ops: What Are the Key Differences?

Nov 19, 2023

Condos and co-ops are two different types of housing with significant distinctions. Ownership structure, funding alternatives, taxes, pricing, and fees are examples of these. Management companies for co-ops and condominiums are distinct. The co-op equivalent of a homeowners' association is a board or committee (HOA). Co-ops sell shares under a fractional ownership structure, whereas condos give exclusive ownership. Co-op shareholders screen each other before the entrance, unlike condo owners. Financial documents, credit histories, and other records may all be examined..

Best Stocks With Monthly Dividends To Buy Now

Jan 15, 2024

Stocks that pay dividends regularly can be held indefinitely without affecting the investor's standard of living. Monthly dividend stocks are popular among investors because they provide a more consistent cash flow than their quarterly and annual counterparts. This post will discuss the top stores offering monthly dividends that investors may buy right now and the rationale behind our selections.

What Does a Stock Quote's Bid and Ask Mean?

Feb 16, 2024

Bid and ask prices are a trader's optimum purchase and sell pricing. The bid cost is the most a buyer is willing to shell out for a financial asset, whereas the asking rate is the least. The bid-ask spread refers to the disparity between bid and ask