Best Stocks With Monthly Dividends To Buy Now

Jan 15, 2024 By Triston Martin

Monthly dividend stocks are popular among investors because they provide a consistent income stream without selling shares. These stocks are a fantastic choice for those looking to generate a reliable monthly income that can be used to augment other resources. Selecting the best monthly dividend stocks for your portfolio is crucial because not all of them are created equal. Some of the most significant stores offering monthly dividends will be discussed here. Supplies with a proven track record of dividend growth, portfolio diversification, and generous yields were prioritized for this list. We will summarise each store and explain why income investors should consider purchasing it. Do your research, considering your investment objectives and level of comfort with risk, before making any financial commitment. But if you're an investor searching for a reliable income stream, the monthly dividend stocks we'll cover here can be a terrific place to start.

Realty Income Corporation (O)

Over 6,500 properties in the United States, the United Kingdom, and Puerto Rico are owned and managed by Realty Income Corporation (O), a real estate investment trust (REIT). Over the last 50 years, the company has consistently paid dividends to its stockholders on a monthly basis. One of Realty Income Corporation's nicknames is best monthly dividend stocks and for good cause. Many tenants, such as shops, convenience stores, and even medical clinics, rent space from the organization. This spreads the revenue stream out, so fewer tenants or sectors can affect the business adversely. Income investors will find O's 4.3% yield to be enticing at the moment.

STAG Industrial (STAG)

Another REIT emphasizing industrial assets is STAG Industrial (STAG). Over 470 of their buildings are rented out to various tenants in logistics, manufacturing, and e-commerce. STAG's emphasis on single-tenant industrial properties is one reason the company appeals to investors. More extended lease agreements at these buildings make the company's income more stable and predictable. STAG's 4.5% yield puts it in a competitive position relative to other equities that pay high monthly dividend stocks.

Gladstone Commercial Corporation (GOOD)

Real estate investment trust Gladstone Commercial Corporation (GOOD) owns and operates more than 120 properties in the United States. Healthcare, retail, and manufacturing tenants lease the company's assets. GOOD has a solid track record of dividend payments, which entices investors. Since 2003, shareholders have received monthly dividend payments from the corporation, which have steadily increased. GOOD's current yield of 5.5% is better than that of many other stocks that pay dividends once every month.

Shaw Communications Inc. (SJR)

Shaw Communications Inc. (SJR) is the go-to provider of phone, internet, and television for Canadian residents. The firm also controls and manages a national system of Wi-Fi access points. SJR's dominant position in the Canadian market is one of the reasons the company is appealing to investors. The corporation is second only to Bell Canada regarding market share among Canadian telecoms. SJR's 3.3% yield is smaller than some other dividend companies that pay out every month, but it's still appealing to income investors.

Main Street Capital Corporation (MAIN)

U.S. businesses in the lower middle market can turn to Main Street Capital Corporation (MAIN), a business development corporation offering debt and equity financing. The firm's portfolio includes approximately two hundred enterprises from various industries. The consistency of MAIN's dividend payments is one of the stock's selling points. The dividend has been paid monthly since 2007 and has increased yearly. MAIN's current yield of 5.2% compares favorably to comparable stocks that pay dividends monthly.

Conclusion

Stocks that pay dividends regularly, such as monthly, can offer investors a steady income stream without the need to liquidate their holdings. Realty Income, STAG Industrial, Gladstone Commercial, Shaw Communications, and Main Street Capital are all excellent dividend companies with stable track records, diversified holdings, and attractive yields. Investors seeking a steady monthly income may consider these options. There is always a degree of risk when investing, so make sure you do your research and give some serious thought to your goals before making any decisions. Investors can create a portfolio that can produce a continuous income stream for years to come by picking the appropriate monthly dividend stocks.

Repairs Notified During Property Condition Verification

Nov 28, 2023

We were initially unable to react to this email since your home buying guide is a REALTOR®. She is not allowed to interfere with another REALTORtransaction ®'s as a fellow REALTOR®! Therefore, the only appropriate response to this was to seek your agent for advice on how to verify the condition of the property.

Should You Purchase A Rental Truck Insurance?

Nov 16, 2023

When renting a moving truck, you should find out if it is covered by insurance. After all, if most of your things are in the truck and something bad happens, you might want to know what kind of protection you have. Here are some things to think about before you rent a moving truck

Understanding the Basics of Form 1099-DIV: A Comprehensive Guide

Jan 07, 2024

Navigate tax reporting with ease! This guide simplifies Form 1099-DIV, highlighting its importance, explaining the information it contains, common mistakes to avoid, and tips for accurate tax filing

Understanding Texas Home Equity Loans and HELOCs

Mar 19, 2024

Discover the ins and outs of Texas home equity loans and HELOCs in this comprehensive guide. Learn how they work and their benefits.

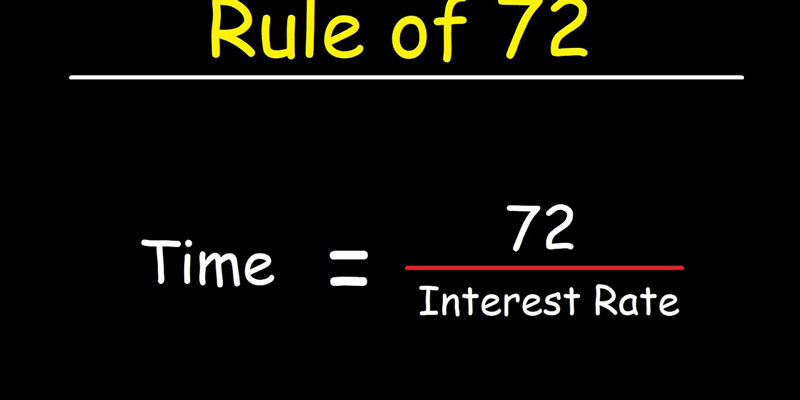

What Is the Rule of 72?

Jan 17, 2024

Rule of 72 is a simplified formula that determines how long the investment's value will take to increase its value according to the rate of return.

Can You Deduct Margin Interest on Your Taxes

Feb 20, 2024

The Internal Revenue Service permits taxpayers to deduct certain costs associated with investments if those costs are directly tied to generating taxable income from investments. Let's look at some of the most frequent deductible investment costs and how they might reduce your taxable income since increasing the amount of tax deductions you claim can decrease the amount of money you owe in taxes

What Does a Stock Quote's Bid and Ask Mean?

Feb 16, 2024

Bid and ask prices are a trader's optimum purchase and sell pricing. The bid cost is the most a buyer is willing to shell out for a financial asset, whereas the asking rate is the least. The bid-ask spread refers to the disparity between bid and ask

All You Need To Know About Absolute Return

Nov 30, 2023

The rate of return earned on an asset over a specified time is called its absolute return. We are looking at the percentage gain or loss that an investment vehicle such as a stock or mutual fund has experienced over time.

Jobs in Nonprofit Accounting

Nov 22, 2023

Accountant the role is just as crucial in the nonprofit sector as it is in the for-profit sector, and the tasks will be identical to those of a professional accountant. Treasurer. Vacancies for full-time financial officers tend to arise at larger nonprofits that attract sufficient funding to justify the position.

How Does Being Evicted Affect Your Credit?

Dec 29, 2023

When a credit bureau hears about an eviction, it can appear on your credit report for up to seven years. This can hurt your credit score, making it harder for you to rent a new place or get credit in the future. To keep your credit score from taking a hit, working with your landlord to solve any problems before you have to move out is essential.

Tips for Teaching Your College-Bound Child About Credit and Debt

Oct 22, 2023

Teaching your college-bound child about credit and debt is important in preparing them for financial independence. By starting early and providing them with the knowledge and tools they need to make informed financial decisions, you can help them avoid financial mistakes and achieve long-term financial stability

Outstanding Shares: What is it?

Jan 30, 2024

Shares outstanding are the total number of shares of a company's stock, usually controlled by all stakeholders. This number includes both Outstanding and Floating Shares.