Do You Know: What Is Reinvestment Risk?

Feb 05, 2024 By Triston Martin

Introduction

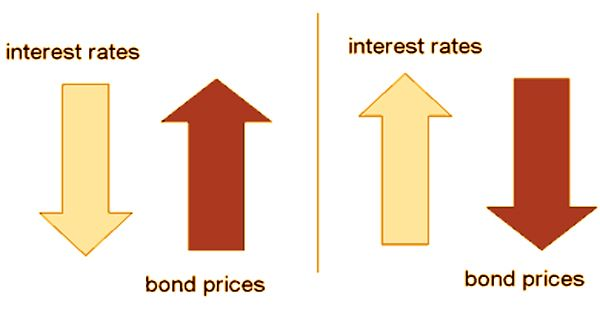

The risk of being forced to reinvest income streams (such as coupon payments or the final return of principle) into lower-yielding securities. To reinvest one's profits at a lower rate than the current rate is known as reinvestment risk. This risk is commonly linked with bond investing but is not limited to that asset class. The risk of loss increases, for example, if you buy a bond whose return rates are falling over time and then reinvest the proceeds in the same bond when they mature.

Reinvestment Risk: An Understanding

The risk of reinvestment occurs when an investor worries that the returns on a new asset will be lower than those on the original investment. There is a possibility that the investor's rate of return may decline, and they will be unable to reinvest cash flows at a pace comparable to that rate. To illustrate, suppose an individual decides to invest $100,000 in a 10-year Treasury note (T-note) bearing a 6% interest rate. The annual return on investment (ROI) sought by the investor is $6,000. After the initial year, however, the interest rate drops to 4%. If the investor reinvested the $6,000 they received, they would receive $240 per year instead of $360 per year on the new bond.

In addition, if interest rates rise after the note is issued and it is sold before it matures, the investor could lose some or all of the initial investment. In addition to bonds and other fixed-income investments, reinvestment risk can impact dividend-paying stocks. To a greater extent, reinvestment risk affects bonds that can be called. This is because holders of callable bonds tend to cash in their holdings when interest rates fall. Upon redemption, the bondholder will receive par value, and the issuer will have another opportunity to borrow funds at a lower interest rate. Investors who are prepared to reinvest will earn a lower interest rate.

How Investment Risk Is Handled

Suppose an investor constructs a bond portfolio when yields are at 5%. The investor commits $100,000 to a 5-year Treasury note with an annual interest rate of 5%. Let's assume that rates on this particular bond class will fall 2% from their current level during the next five years. At maturity, the bondholder would get $100,000 plus all accrued interest (five percent per year). There is a problem in that if the investor were to buy another bond of the same class, they would no longer get interest payments of 5% but would instead have to reinvest their money at the lower market rates. The previous note provided annual revenues of $5,000, but this new one would only offer yearly payments of $2,000.

Reinvestment Risk Management

Reinvestment risk can be mitigated through the purchase of non-callable securities. Since Z-bonds do not have a regular interest payment schedule, they are also available for sale. With less frequent access to cash and a corresponding reduction in the frequency with which it must be reinvestment, longer-term securities may be a viable alternative. A bond ladder is a portfolio of fixed-income assets with varying maturity dates used to mitigate reinvestment risk. It's possible that bonds with higher interest rates at maturity could compensate for those with lower yields.

A similar method can be applied to Certificates of Deposit (CDs). Investors can mitigate the threat of reinvestment by owning bonds of varying maturities and using interest rate derivatives to protect their portfolios. Since having a fund manager might help reduce reinvestment risk, some investors consider placing money into actively managed bond funds. Reinvestment risk continues to be a factor because bond rates increase in tandem with the market.

What Individual Investors Should Know About Reinvestment Risk

It is not uncommon for investors to try to make up for lost interest income by purchasing high-yield bonds, as they did in large numbers after the 2008 financial market crisis when interest rates were meagre. Commonly referred to as "junk bonds"). This strategy is understandable, but its efficacy is questionable because garbage bonds fail at exceptionally high rates when the economy isn't operating well, which often correlates with a low-interest rate environment.

Conclusion

There is no requirement that you invest bond proceeds in more bonds. If such money were placed in assets unaffected by falling interest rates, the risk of reinvestment might be mitigated. With the help of monetary gurus, it is possible to increase your investment portfolio. Reinvestment rate risk refers to the potential loss in value resulting from reinvesting future cash flows at a lower rate of return because of declining interest rates. Fixed-income assets, especially callable bonds, are often associated with reinvestment rate risk. Likewise, this is particularly crucial for shorter-term bonds and investors. Investors can mitigate their exposure to the reinvestment rate risk by allocating capital to assets with a longer time horizon.

All You Need to Know about Subprime Mortgage

Oct 11, 2023

Customers with weak credit histories may apply for subprime mortgages, which carry high-interest rates. These loans allow people with bad credit to purchase houses, but they come with a high degree of risk

Can You Deduct Margin Interest on Your Taxes

Feb 20, 2024

The Internal Revenue Service permits taxpayers to deduct certain costs associated with investments if those costs are directly tied to generating taxable income from investments. Let's look at some of the most frequent deductible investment costs and how they might reduce your taxable income since increasing the amount of tax deductions you claim can decrease the amount of money you owe in taxes

Tips for Teaching Your College-Bound Child About Credit and Debt

Oct 22, 2023

Teaching your college-bound child about credit and debt is important in preparing them for financial independence. By starting early and providing them with the knowledge and tools they need to make informed financial decisions, you can help them avoid financial mistakes and achieve long-term financial stability

The Top Gold Exchange-Traded Funds to Hedge Volatility

Oct 16, 2023

There is more than one way to acquire exposure to gold, the most direct of which is the purchase of gold bullion. Other means, such as ownership of shares in public mining firms, are more indirect. Exchange-traded funds (ETFs) that include gold as their underlying asset are the most effective way for ordinary investors to get a piece of the action because of the low transaction costs. While some funds directly invest in the metal itself, others instead manage a portfolio of equities tied to the gold industry.

All You Need To Know About Absolute Return

Nov 30, 2023

The rate of return earned on an asset over a specified time is called its absolute return. We are looking at the percentage gain or loss that an investment vehicle such as a stock or mutual fund has experienced over time.

What To Do About Your Student Loans in 5 Easy Steps

Oct 11, 2023

Do you feel completely paralyzed by the weight of your student loans? The good news is that you have a company: More than $1.6 trillion has been borrowed for education in the United States. That's just slightly smaller than the total national mortgage debt. Student debt makes it more difficult for recent graduates to enter the housing market.

Offer in Compromise: Get to know How to Settle Your Tax Debt?

Oct 09, 2023

You can negotiate a reduced tax liability settlement using an Offer in Compromise. It may be a viable alternative if you cannot fully pay your tax bill.

Comparing Condos vs. Co-ops: What Are the Key Differences?

Nov 19, 2023

Condos and co-ops are two different types of housing with significant distinctions. Ownership structure, funding alternatives, taxes, pricing, and fees are examples of these. Management companies for co-ops and condominiums are distinct. The co-op equivalent of a homeowners' association is a board or committee (HOA). Co-ops sell shares under a fractional ownership structure, whereas condos give exclusive ownership. Co-op shareholders screen each other before the entrance, unlike condo owners. Financial documents, credit histories, and other records may all be examined..

Best Stocks With Monthly Dividends To Buy Now

Jan 15, 2024

Stocks that pay dividends regularly can be held indefinitely without affecting the investor's standard of living. Monthly dividend stocks are popular among investors because they provide a more consistent cash flow than their quarterly and annual counterparts. This post will discuss the top stores offering monthly dividends that investors may buy right now and the rationale behind our selections.

Cons and Advantages of Combining Home and Auto Insurance

Dec 31, 2023

Customers who "bundle" their policies—that is, buy both types of insurance from the same carrier—often receive discounts from the insurer. They do this because you are more likely to buy more policies and there is less chance that you will move to a different insurer when you receive the discount.

Do You Know: What Is Reinvestment Risk?

Feb 05, 2024

Cash flows from an investment, such as interest or coupon payments, are subject to reinvestment risk if the investor is concerned about not being able to reinvest them at a rate of return at least equal to the current rate. This new interest rate is known as the reinvestment rate. Since zero-coupon bonds never pay a coupon, they are risk-free investments.

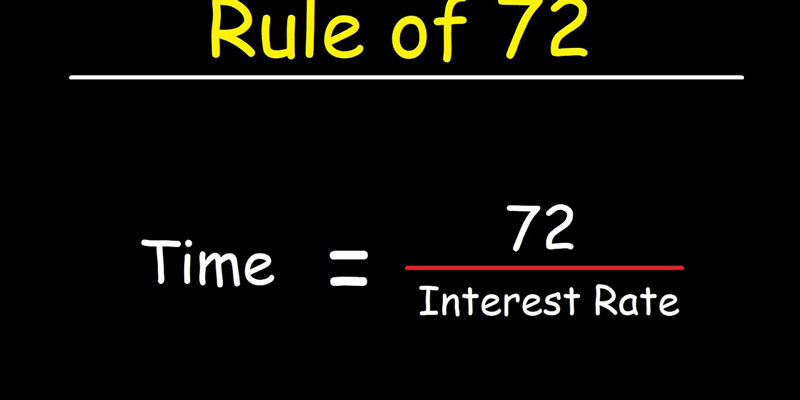

What Is the Rule of 72?

Jan 17, 2024

Rule of 72 is a simplified formula that determines how long the investment's value will take to increase its value according to the rate of return.