How Does Group Life Insurance Work?

Nov 29, 2023 By Susan Kelly

In a group life insurance plan, individuals are covered by a policy purchased and paid for by their company or another big group, such as a trade union or professional organization. It is widely available across the country, costs nothing to implement, and may even be free for some staff members.

It's common for group life insurance to be part of a broader benefits package provided by an employer or membership organization, and its coverage is usually modest. There is no requirement for an individual to undergo medical testing or undergo separate underwriting to be covered by group life insurance.

Comprehending Group Life Insurance

It is called group life insurance when many people are covered under the same insurance policy. Companies may acquire charges for each employee that are significantly cheaper than if they were to get an individual approach by purchasing group life insurance policy coverage via an insurance provider on a wholesale basis.

Group life insurance recipients may incur no out-of-pocket expenses to cash in on their benefits. Those who choose the advanced supplementary coverage may have their premiums for such coverage withdrawn directly from their paychecks.

Before an insurance policy becomes active, the insured must name one or more beneficiaries, just like regular insurance. The beneficiary can be changed at any time throughout the policy's duration.

Conditions for Group Life Insurance Coverage

Conditions are frequently included in group life insurance plans. To receive benefits from a group, some companies mandate a certain length of membership. An employee's eligibility for health and life insurance coverage, for instance, may be contingent on their successful completion of a probationary term.

Typically, one is only covered for as long as they are a part of the organization. Coverage stops whether a member quits voluntarily or is let go for cause.

Different Types of Group Life Insurance

In particular, there are two categories of group life insurance, and they are as follows:

- Contributory

- Non-contributory

The premium for a contributory group, a life insurance policy, is split between the employees and the company. Employees often get more comprehensive coverage than they might obtain through an individual insurance policy since the cost of the contributions is shared between the company and the employee.

Contributory group life insurance plans are typically issued to workers without requiring a medical exam or physical. Employees may opt out of the program if they must pay for a portion of the coverage premium with their after-tax income.

Employees typically have little leeway in determining their level of coverage through contributory group life insurance policies, another drawback of these plans.

Cons and Pros of Group Life Insurance

The cost-effectiveness of group life insurance is why many workers sign up for it. Members of the group often contribute little or nothing.

Their weekly or monthly gross wages are deducted straight to cover any premiums. It's simple to get accepted into a group policy, and everyone in the group is automatically covered. In contrast to individual coverage, group health insurance plans do not need a physical.

However, one must go below the surface of low price and ease of use. The standard level of coverage in group life insurance policies is sometimes insufficient for policyholders' demands. It's common to insure for a sum of $20,000 to $50,000 or even once or double the insured's yearly wage.

Why Do People Have Group Life Insurance?

The beneficiaries of an insured employee who passes away while covered by the company's group life insurance policy get a payout. The goal is to help these workers' families out financially.

What Happens To Group Life Insurance When I Retire?

Group life insurance coverage ends when you quit your employer. Examples include being laid off, resigning, switching employment, or retiring. After retirement, some workers can change from group health insurance to individual coverage, but their former employer may no longer be responsible for paying their costs.

How Many Varieties of Group Life Insurance Are There?

Most organizations opt for annual renewable group term insurance policies for their employees. This sort of insurance is the cheapest, but it just covers death. The death benefit and cash value can grow with a group universal life policy, but it comes at a higher premium. Group universal life insurance with a variable premium allows policyholders to diversify their cash value investment portfolio.

The Verdict

If the insured person passes away within the policy's term, the beneficiaries will get the death benefit. Life insurance for a limited period might be an excellent option because of the low cost. However, if you want additional coverage or wish to have coverage in place beyond your lifetime, this may not be sufficient to fulfill your financial demands.

What To Do About Your Student Loans in 5 Easy Steps

Oct 11, 2023

Do you feel completely paralyzed by the weight of your student loans? The good news is that you have a company: More than $1.6 trillion has been borrowed for education in the United States. That's just slightly smaller than the total national mortgage debt. Student debt makes it more difficult for recent graduates to enter the housing market.

Do You Know: What Is Reinvestment Risk?

Feb 05, 2024

Cash flows from an investment, such as interest or coupon payments, are subject to reinvestment risk if the investor is concerned about not being able to reinvest them at a rate of return at least equal to the current rate. This new interest rate is known as the reinvestment rate. Since zero-coupon bonds never pay a coupon, they are risk-free investments.

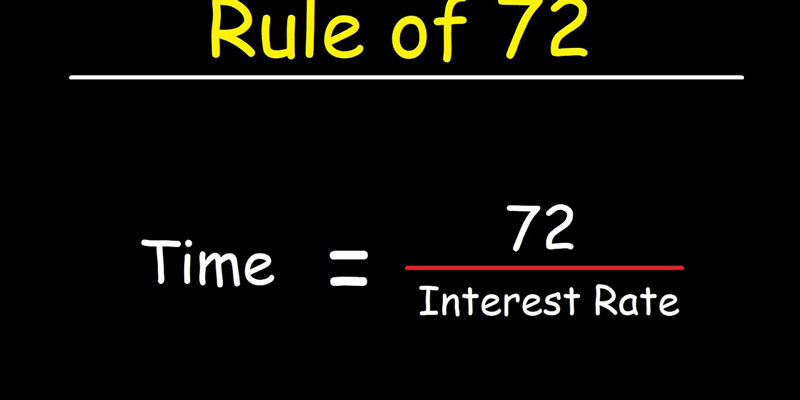

What Is the Rule of 72?

Jan 17, 2024

Rule of 72 is a simplified formula that determines how long the investment's value will take to increase its value according to the rate of return.

Jobs in Nonprofit Accounting

Nov 22, 2023

Accountant the role is just as crucial in the nonprofit sector as it is in the for-profit sector, and the tasks will be identical to those of a professional accountant. Treasurer. Vacancies for full-time financial officers tend to arise at larger nonprofits that attract sufficient funding to justify the position.

How Long Does it Take to Get a Mortgage Pre-Approval

Feb 25, 2024

Buying a home is an exciting - and intimidating - process. Find out how long you can expect to wait for pre-approval on your mortgage and what factors might affect the timeline.

Should You Purchase A Rental Truck Insurance?

Nov 16, 2023

When renting a moving truck, you should find out if it is covered by insurance. After all, if most of your things are in the truck and something bad happens, you might want to know what kind of protection you have. Here are some things to think about before you rent a moving truck

Repairs Notified During Property Condition Verification

Nov 28, 2023

We were initially unable to react to this email since your home buying guide is a REALTOR®. She is not allowed to interfere with another REALTORtransaction ®'s as a fellow REALTOR®! Therefore, the only appropriate response to this was to seek your agent for advice on how to verify the condition of the property.

What Amount Should You Deposit on a House?

Feb 05, 2024

For the majority of loan types and lenders, a 20% down payment is generally regarded as the best down payment amount. You'll benefit greatly if you can put 20% down on your house..

All You Need To Know About Absolute Return

Nov 30, 2023

The rate of return earned on an asset over a specified time is called its absolute return. We are looking at the percentage gain or loss that an investment vehicle such as a stock or mutual fund has experienced over time.

Tips for Teaching Your College-Bound Child About Credit and Debt

Oct 22, 2023

Teaching your college-bound child about credit and debt is important in preparing them for financial independence. By starting early and providing them with the knowledge and tools they need to make informed financial decisions, you can help them avoid financial mistakes and achieve long-term financial stability

Oregon Mortgage Lenders

Dec 07, 2023

These mortgage lenders can assist you regardless of whether you are a first-time home buyer, need to make a modest down payment, are looking for a lender that doesn't mind a poor credit score, prefer an internet lender, or want to borrow against the equity in your home.

A Guide To Earning Money On eBay

Jan 25, 2024

There is a need for a centralized location where individuals can meet to do business via the internet, and this is precisely what e-commerce platforms aim to provide. The only way to make money on such an e-commerce site is to sell something.