Navigating Home Equity Loans

Mar 19, 2024 By Triston Martin

Are you considering a home equity loan? Simplify the process with a Home Equity Loan Finder. The daunting task of finding the right loan becomes more manageable when facing numerous lenders and varying rates. Navigate the options efficiently with insights from this guide. Understand home equity loans' intricacies, differentiating between fixed-rate and variable-rate choices. Thoroughly analyze your financial situation. Ascertain an amount you can comfortably borrow and promptly repay. With our guidance, you'll confidently navigate the complexities of securing a home equity loan.

1. Understanding Home Equity Loans

Mastering an understanding of home equity loans is crucial before delving into the selection process. Homeowners essentially leverage these loans to borrow against their accumulated property equity. Unlike other forms of lending, these are secured with the house serving as collateral, a key distinction in the financial landscape.

Typically, home equity loans offer a consistent fixed interest rate throughout the loan term. This provides borrowers with monthly payment predictability and simplifies budgeting. However, borrowers must acknowledge that not repaying a home equity loan might trigger foreclosure due to the lender's property claim.

- Caution: Home equity loans may have closing costs associated with them, such as appraisal fees and origination fees. Ensure to factor in these costs when calculating the total expense of the loan.

- Noteworthy: Some home equity loans offer the option for interest-only payments during the initial period, followed by principal and interest payments later. Consider the long-term implications of this payment structure before committing to it.

2. Factors to Consider

The suitability of a home equity loan hinges on several factors such as interest rates, repayment terms, and fees. Moreover, borrowers must conduct an assessment of their financial situation. They should consider elements such as credit score, income stability, and existing debts.

Moreover, borrowers must evaluate their forthcoming financial strategies during the contemplation of a home equity loan. For example, if they plan to sell their house soon, they must consider how this loan could potentially affect resale value. Additionally, exploring alternatives like personal loans or lines of credit instead of home equity loans ensures a selection of the most advantageous financing option.

- Consideration: Home equity loans may offer tax-deductible interest, making them a favorable option for certain borrowers. Consult with a tax advisor to understand the potential tax benefits of a home equity loan in your specific situation.

- Fact: Lenders typically allow borrowers to borrow up to a certain percentage of their home's appraised value, minus any outstanding mortgage balance. This percentage, known as the loan-to-value ratio, varies among lenders and depends on factors like credit score and income.

3. Using the Loan Finder

The Home Equity Loan Finder optimizes the quest for an ideal loan. Borrowers input specific criteria on the amount, desired term, and credit score. This prompts access to a curated list of lenders. These financial partners offer tailored options that best suit your needs.

Besides conventional lenders such as banks and credit unions, borrowers have the opportunity to investigate online lending platforms for home equity loans. These resources frequently offer competitive rates and user-friendly application procedures. Moreover, when a borrower utilizes a loan finder tool, they can compare numerous offers with efficiency. This empowers them to make informed decisions about their financing requirements.

- Note: When using a loan finder tool, ensure to provide accurate information to receive the most relevant loan options. Inaccurate information may lead to mismatched loan offers that do not meet your needs.

- Reminder: Before finalizing a loan application, review the terms and conditions carefully, including the interest rate, repayment schedule, and any associated fees. Ensure you fully understand the obligations and responsibilities outlined in the loan agreement before proceeding.

4. Comparing Loan Options

Armed with a list of potential lenders, you must embark on the next step which is comparison. Analyze interest rates, and scrutinize repayment terms and fees. Consider them meticulously. Take into account the total cost of borrowing. This includes not just closing costs but also any prepayment penalties that may apply.

Borrowers should also scrutinize each lender's offered flexibility in repayment options. Certain lenders might permit bi-weekly or accelerated payment schedules, potentially enabling borrowers to save on interest and expedite loan payoff. Furthermore, the reputation and reliability of every lender, encompassing their customer service quality as well as responsiveness to inquiries, warrant consideration.

- Tip: Utilize online loan comparison tools to facilitate side-by-side comparisons of loan offers from different lenders. These tools often provide comprehensive breakdowns of key loan terms and costs, simplifying the decision-making process.

- Important: Beware of teaser rates offered by some lenders, which may initially appear attractive but can increase significantly after an introductory period. Always consider the long-term implications of the loan terms rather than solely focusing on the initial rate.

5. Selecting the Best Option

Thoroughly evaluate and select the home equity loan that aligns best with your financial goals and circumstances. Make sure you choose a loan offering favorable terms and manageable payments. Also, be cautious of hidden costs and prioritize transparency.

Moreover, borrowers must maintain an open line of communication with their selected lender during the application and approval process. They should not hesitate to seek clarification on any uncertainties related to loan terms or requirements. This proactive approach will prevent future misunderstandings. Finally, continue monitoring your financial situation regularly. Be prepared for a potential revision in your loan terms, particularly if there are fluctuations in income or expenses.

- Reminder: Consider the potential impact of interest rate fluctuations on your loan payments, especially if you opt for a variable-rate home equity loan. Have a plan in place to manage potential increases in interest rates to avoid financial strain in the future.

- Caution: Avoid borrowing more than you need or can comfortably repay. While it may be tempting to access additional funds through a home equity loan, overborrowing can lead to financial stress and jeopardize your home's equity position. Be conservative in your borrowing decisions and prioritize long-term financial stability.

Conclusion

Diligence and understanding are necessary to navigate the realm of home equity loans. Simplify this process by using our Home Equity Loan Finder, which allows for informed decisions. Always prioritize affordability and suitability when considering all aspects of the loan. By doing so, you can leverage your home equity wisely for financial empowerment.

A Step-by-Step On How To Find Your Social Security Number

Dec 12, 2023

Looking for your social security number but need help figuring out where to start? Here are the steps you can take to locate your number and safeguard yourself against potential fraud quickly

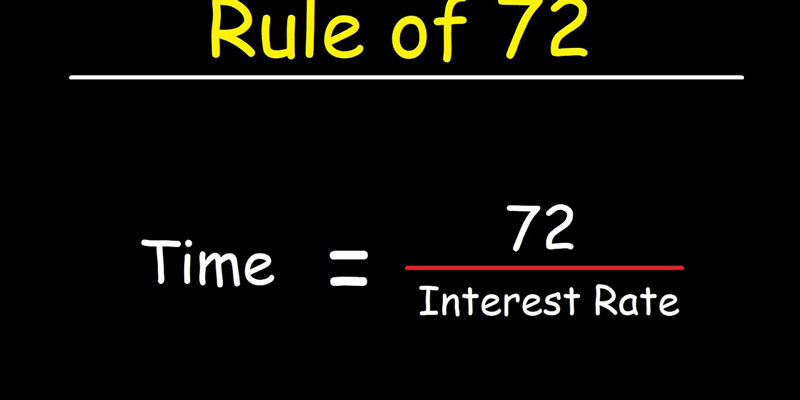

What Is the Rule of 72?

Jan 17, 2024

Rule of 72 is a simplified formula that determines how long the investment's value will take to increase its value according to the rate of return.

How Does Being Evicted Affect Your Credit?

Dec 29, 2023

When a credit bureau hears about an eviction, it can appear on your credit report for up to seven years. This can hurt your credit score, making it harder for you to rent a new place or get credit in the future. To keep your credit score from taking a hit, working with your landlord to solve any problems before you have to move out is essential.

What To Do About Your Student Loans in 5 Easy Steps

Oct 11, 2023

Do you feel completely paralyzed by the weight of your student loans? The good news is that you have a company: More than $1.6 trillion has been borrowed for education in the United States. That's just slightly smaller than the total national mortgage debt. Student debt makes it more difficult for recent graduates to enter the housing market.

Best Real Estate Agencies in 2023

Dec 05, 2023

The real estate market across the country is rising. In many parts of the country, a home will be on the market for a week before it is swamped with bids from potential buyers. Because mortgage rates are at record lows, the market favours sellers like never before, and buyers are snapping up homes on the market faster than ever before

Should You Purchase A Rental Truck Insurance?

Nov 16, 2023

When renting a moving truck, you should find out if it is covered by insurance. After all, if most of your things are in the truck and something bad happens, you might want to know what kind of protection you have. Here are some things to think about before you rent a moving truck

Best Stocks With Monthly Dividends To Buy Now

Jan 15, 2024

Stocks that pay dividends regularly can be held indefinitely without affecting the investor's standard of living. Monthly dividend stocks are popular among investors because they provide a more consistent cash flow than their quarterly and annual counterparts. This post will discuss the top stores offering monthly dividends that investors may buy right now and the rationale behind our selections.

What Amount Should You Deposit on a House?

Feb 05, 2024

For the majority of loan types and lenders, a 20% down payment is generally regarded as the best down payment amount. You'll benefit greatly if you can put 20% down on your house..

Repairs Notified During Property Condition Verification

Nov 28, 2023

We were initially unable to react to this email since your home buying guide is a REALTOR®. She is not allowed to interfere with another REALTORtransaction ®'s as a fellow REALTOR®! Therefore, the only appropriate response to this was to seek your agent for advice on how to verify the condition of the property.

Jobs in Nonprofit Accounting

Nov 22, 2023

Accountant the role is just as crucial in the nonprofit sector as it is in the for-profit sector, and the tasks will be identical to those of a professional accountant. Treasurer. Vacancies for full-time financial officers tend to arise at larger nonprofits that attract sufficient funding to justify the position.

What Does a Stock Quote's Bid and Ask Mean?

Feb 16, 2024

Bid and ask prices are a trader's optimum purchase and sell pricing. The bid cost is the most a buyer is willing to shell out for a financial asset, whereas the asking rate is the least. The bid-ask spread refers to the disparity between bid and ask

Offer in Compromise: Get to know How to Settle Your Tax Debt?

Oct 09, 2023

You can negotiate a reduced tax liability settlement using an Offer in Compromise. It may be a viable alternative if you cannot fully pay your tax bill.